10 Financial Mistakes to Avoid in Your 20s for a Secure Financial Future

Your 20s are a critical time that can shape your financial future. Many young adults don’t realize that the money choices they make now can have long-lasting consequences. This isn’t about being perfect with money, but about avoiding common financial mistakes that can hold you back.

Think of your 20s as a financial launching pad. Every decision you make – from how you spend and save to the debts you take on – can either build a strong foundation or create obstacles that take years to overcome. The good news is that with the right knowledge, you can sidestep the most common financial pitfalls.

In this guide, we’ll break down 10 critical financial mistakes that can derail your financial health. These aren’t just theoretical warnings, but practical insights that can help you make smarter money choices and set yourself up for long-term success.

1. Not Creating a Budget: The Foundation of Financial Success

Without a budget, you’re essentially flying blind, and that’s a recipe for financial disaster. It’s easy to lose track of your spending when you’re not keeping tabs on it, leading to unnecessary debt and missed opportunities to save. But here’s the thing—budgeting doesn’t have to be complicated. In fact, it can be surprisingly simple.

Start by listing your income sources and your monthly expenses. Then, categorize those expenses into essentials (like rent and groceries) and non-essentials (like that daily latte). The goal? Make sure you’re living within your means while still setting aside money for savings and investments. Tools like budgeting apps can help you stay on track, making the process almost painless. Remember, a budget isn’t about restricting your freedom; it’s about giving you control over your finances.

Why Budgeting Matters:

· Control: A budget gives you control over your money, instead of your money controlling you.

· Awareness: It helps you understand where your money is going, often revealing surprising spending patterns.

· Goal Setting: With a budget, you can align your spending with your financial goals.

· Peace of Mind: Knowing exactly where you stand financially reduces stress and anxiety.

I remember when I first started budgeting in my early 20’s. It was eye-opening to see how much I was spending on “small” daily purchases like coffee and lunch out. These seemingly insignificant expenses were actually eating up a significant portion of my income.

Simple Budgeting Techniques for Beginners:

1. The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

2. Zero-Based Budgeting: Give every dollar a job, ensuring your income minus expenses equals zero.

3. Envelope System: Use physical envelopes or digital categories to allocate spending for different expense categories.

Pro Tip: Use budgeting apps like Mint or YNAB (You Need A Budget) to make tracking your expenses easier. These tools can sync with your bank accounts and credit cards, giving you a real-time view of your financial picture.

Remember, a budget isn’t about restriction – it’s about empowerment. It’s about making conscious choices with your money that align with your values and goals.

2. Neglecting to Build an Emergency Fund: Your Financial Safety Net

Neglecting to build an emergency fund is one of the biggest financial mistakes you can make in your 20s. Without it, you’re vulnerable to falling into debt whenever an unexpected expense pops up. And trust me, it’s not a matter of if something will go wrong, but when.

Starting an emergency fund might seem daunting, especially when you’re trying to manage all your other expenses. But here’s the trick: start small. Aim to save at least three to six months’ worth of living expenses. You don’t need to hit this target overnight—gradually build your fund over time. Automatic transfers to a separate savings account can make this process easier and more consistent.

Importance of Financial Safety Nets:

· Peace of Mind: Knowing you have a cushion reduces financial stress.

· Avoid Debt: An emergency fund prevents you from relying on high-interest credit cards in a crisis.

· Financial Flexibility: It gives you the freedom to take calculated risks, like changing careers.

How to Start and Maintain an Emergency Fund:

1. Set a Goal: Aim for 3-6 months of living expenses.

2. Start Small: Even $500-$1000 can make a big difference in an emergency.

3. Automate Savings: Set up automatic transfers to your emergency fund each payday.

4. Use a High-Yield Savings Account: Make your money work for you with better interest rates.

I learned the importance of an emergency fund the hard way when I was laid off from my first job out of college. Without savings to fall back on, I had to move back in with my parents and take on credit card debt to make ends meet. Don’t make the same mistake I did.

Pro Tip: Consider using a platform like Ally Bank or Marcus by Goldman Sachs for your emergency fund. These online banks often offer higher interest rates than traditional brick-and-mortar banks.

Remember, an emergency fund isn’t just about preparing for the worst – it’s about giving yourself the freedom to seize opportunities when they arise. It’s a key component of financial health that you’ll thank yourself for building in your 20’s.

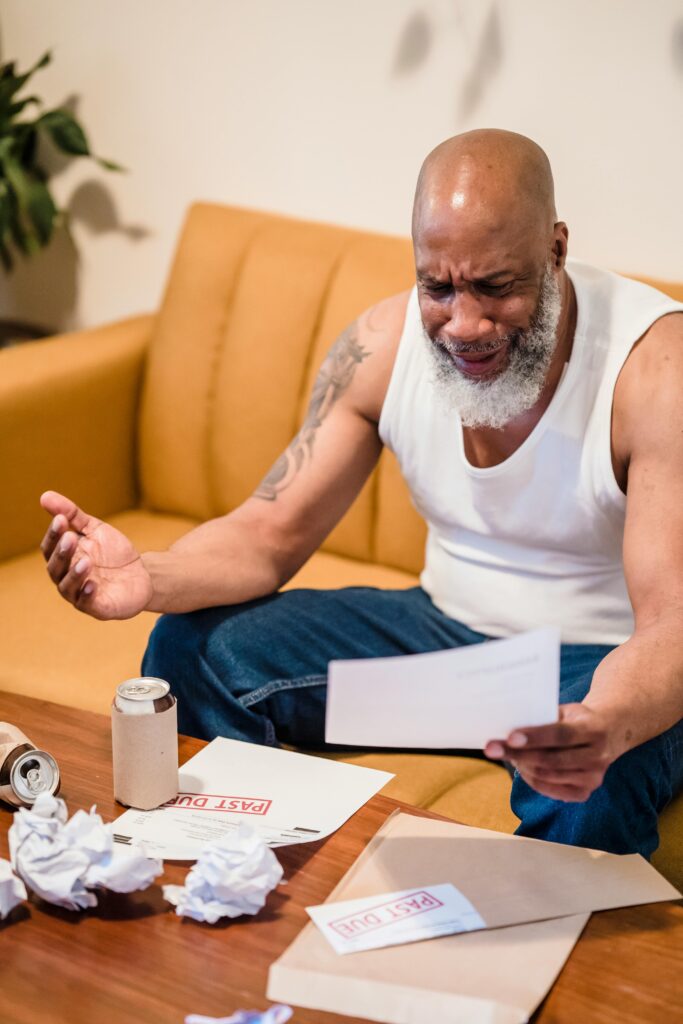

3. Accumulating High-Interest Debt: The Silent Wealth Killer

When you’re in your 20s, the allure of easy credit can be hard to resist. Credit cards offer instant gratification—swipe now, pay later. But here’s the catch: if you’re not careful, that plastic card in your wallet can quickly become your worst financial enemy.

A. Dangers of Credit Card Debt:

· Interest Trap: With average credit card interest rates hovering around 16-20%, your debt can quickly spiral out of control.

· Credit Score Impact: High credit card balances can lower your credit score, affecting future loans and job prospects.

· Financial Stress: Carrying debt can cause anxiety and limit your financial freedom.

I remember maxing out my first credit card on a shopping spree in my early 20’s. The thrill of those new purchases quickly faded when I realized how long it would take to pay off the balance.

B. Strategies to Avoid and Manage Debt:

- Pay in Full: Always aim to pay your credit card balance in full each month.

2. Use the Snowball or Avalanche Method: For existing debt, either pay off the smallest balances first (snowball) or focus on the highest interest rates (avalanche).

3. Consider Balance Transfers: Look for 0% APR balance transfer offers to consolidate and pay off debt faster.

4. Build an Emergency Fund: This prevents you from relying on credit cards for unexpected expenses.

Pro Tip: Use apps like Credit Karma or Mint to monitor your credit score and track your debt payoff progress.

4. Ignoring Retirement Savings: Your Future Self Will Thank You

In your 20s, retirement can feel like a distant concern—something to worry about later. But the truth is, the earlier you start saving for retirement, the easier it will be to build a comfortable nest egg. Time is your greatest asset when it comes to growing your wealth, and ignoring retirement savings now is a mistake you can’t afford to make.

A. Power of Compound Interest:

Let’s talk about the magic of compound interest—where your money earns interest, and then that interest earns interest, creating a snowball effect. The earlier you start saving, the more time compound interest has to work its magic. Even small, regular contributions can grow into a substantial sum over the years.

Consider this: if you start saving $200 a month at age 25, with an average annual return of 7%, you could have over $500,000 by the time you’re 65. Wait until you’re 35 to start, and that figure drops to around $250,000. That’s the power of compound interest, and it’s why starting early is crucial.

B. Introduction to Retirement Accounts (401(k), IRA)

So, where should you stash your retirement savings? Start with a 401(k) if your employer offers one, especially if they match contributions. Employer matching is essentially free money—don’t leave it on the table. A 401(k) allows you to contribute pre-tax income, reducing your taxable income and growing your savings tax-deferred until retirement.

Two main types

If a 401(k) isn’t an option, or you want to save even more, consider an Individual Retirement Account (IRA). There are two main types: Traditional and Roth. With a Traditional IRA, your contributions may be tax-deductible, and your earnings grow tax-deferred. With a Roth IRA, contributions are made with after-tax dollars, but your withdrawals in retirement are tax-free. Both are excellent tools for building your retirement savings.

I started contributing to my 401(k) as soon as I landed my first job out of college. It wasn’t much, but those early contributions have grown significantly over the years.

Pro Tip: Consider using a robo-advisor like Betterment or Wealthfront to start investing for retirement. They offer low fees and automatic portfolio rebalancing.

5. Living Beyond Your Means: The Fast Track to Financial Stress

In a world where social media showcases the best of everyone’s lives, it’s easy to fall into the trap of lifestyle inflation—spending more as you earn more. But living beyond your means can lead to financial stress and, eventually, financial ruin. The key to long-term financial health is learning to live within your means, no matter how much you earn.

A. Lifestyle Inflation and Its Consequences:

· Debt Accumulation: Spending more than you earn often leads to credit card debt.

· Reduced Savings: When you’re overspending, saving becomes nearly impossible.

· Financial Stress: Living paycheck to paycheck can cause significant anxiety.

I’ve seen many friends fall into this trap, upgrading their lifestyle with each pay raise only to find themselves stuck in a cycle of debt and stress.

B. Tips for Living Within Your Means:

To avoid lifestyle inflation, start by setting financial goals that prioritize savings and investments over spending. Track your expenses carefully and be mindful of where your money is going. Consider the 50/30/20 rule as a guideline—allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

Before making a big purchase, ask yourself if it aligns with your long-term goals. Do you really need that brand-new car, or could you stick with your reliable used one and save the difference? Can you find joy in simple pleasures rather than expensive experiences?

1. Track Your Spending: Use apps like YNAB or Mint to understand where your money is going.

2. Practice Delayed Gratification: Wait 24 hours before making non-essential purchases.

3. Focus on Experiences, Not Things: Research shows experiences bring more lasting happiness than material possessions.

4. Learn to Cook: Eating out less can significantly reduce your expenses.

5. Find Free or Low-Cost Entertainment: Explore local parks, museums, or community events.

Living within your means isn’t about depriving yourself; it’s about making smart choices that align with your values and financial goals. By doing so, you’ll build a solid financial foundation that will serve you well throughout your life.

Pro Tip: Try the 50/30/20 budgeting rule: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

6. Not Investing Early: Time is Your Greatest Asset

One of the biggest regrets I hear from people in their 30s and beyond is not starting to invest sooner. Investing early is like planting a tree—the earlier you plant it, the more time it has to grow and bear fruit. The same goes for your investments. The sooner you start, the more time your money has to grow, thanks to the power of compound returns.

A. Benefits of Early Investing:

Starting to invest in your 20s gives you a significant advantage—time. The longer your money is invested, the more it can grow. Even small investments made consistently over time can result in substantial wealth due to the magic of compounding. With compound returns, you earn interest on your initial investment, and then you earn interest on that interest, leading to exponential growth over time.

· Compound Interest: The earlier you start, the more time your money has to grow.

· Risk Tolerance: You can afford to take more calculated risks when you’re young.

· Learning Opportunity: Starting early gives you time to learn from mistakes and refine your strategy.

I started investing small amounts in my mid-20’s, and I’m amazed at how those early investments have grown over the years.

B. Basic Investment Options for Beginners:

If you’re new to investing, the options can seem overwhelming. But you don’t need to be a financial expert to start. Begin with simple, low-cost options like index funds or exchange-traded funds (ETFs). These funds track a broad market index, offering you diversification and lower risk compared to individual stocks.

Robo-advisers

Robo-advisors are another excellent option for beginners. These automated platforms create and manage a diversified portfolio based on your risk tolerance and goals. They’re affordable and take the guesswork out of investing, making them perfect for those who want to start with minimal effort.

For those ready to dip their toes into the stock market, start with a small portion of your portfolio. Look for companies with strong fundamentals and a history of consistent performance. And remember, investing is a marathon, not a sprint—stay patient and avoid making impulsive decisions based on short-term market fluctuations.

1. Index Funds: Low-cost funds that track market indices like the S&P 500.

2. ETFs (Exchange-Traded Funds): Similar to index funds but traded like stocks.

3. Robo-Advisors: Platforms like Betterment or Wealthfront that automate investing.

4. Individual Stocks: Riskier but potentially more rewarding. Start small and diversify.

Pro Tip: Consider using a micro-investing app like Acorns to get started. It rounds up your purchases and invests the spare change.

7. Neglecting to Build Credit: Your Financial Reputation Matters

In today’s world, a good credit score is more than just a number—it’s a vital part of your financial identity. Your credit score affects your ability to rent an apartment, get a loan, or even land certain jobs. Yet, many people in their 20s overlook the importance of building credit, not realizing the impact it can have on their future.

A. Importance of a Good Credit Score:

· Better Loan Terms: A good credit score can save you thousands in interest over your lifetime.

· Rental Applications: Landlords often check credit scores.

· Job Opportunities: Some employers check credit as part of background checks

On the flip side, a poor or non-existent credit score can lead to higher interest rates, or worse, being denied credit altogether. This can make it challenging to finance big purchases or even rent an apartment. In some cases, a bad credit score can even affect your ability to get a job, particularly in financial or managerial roles where trustworthiness is key.

I once missed out on my dream apartment because of a poor credit score. Don’t make the same mistake.

B. Responsible Ways to Build Credit:

1. Get a Secured Credit Card: Use it for small purchases and pay it off monthly.

2. Become an Authorized User: Ask a family member with good credit to add you to their card.

3. Pay Bills on Time: Set up automatic payments to never miss a due date.

4. Keep Credit Utilization Low: Try to use less than 30% of your available credit.

Pro Tip: Use Credit Karma or Annual Credit Report to monitor your credit score for free.

8. Overspending on Housing: Finding the Right Balance

Housing is one of the most significant expenses you’ll face in your 20s, and it’s easy to get carried away. Whether it’s renting a trendy apartment in the city or buying a starter home, overspending on housing can strain your finances and leave little room for saving or investing.

A. The 30% Rule for Housing Expenses:

Aim to spend no more than 30% of your gross income on housing. This includes rent/mortgage, utilities, and maintenance.

However, in high-cost areas, this rule can be challenging to follow. If you find yourself spending more than 30%, you may need to make adjustments in other areas of your budget to avoid financial strain. On the other hand, if you’re able to spend less than 30%, you’ll free up more money to invest in your future.

B. Weighing the Rent vs. Buy Decision:

Deciding whether to rent or buy is a significant financial decision that depends on several factors, including your financial situation, lifestyle, and long-term goals. Renting offers flexibility, with lower upfront costs and no responsibility for maintenance or repairs. It’s an excellent option if you’re not sure where you want to settle down or if you’re focused on building savings and investments.

Buying

Buying a home, however, can be a good investment if you’re ready to stay in one place for several years. Homeownership allows you to build equity over time, and with interest rates at historical lows, it can be cheaper than renting in some markets. But remember, buying comes with additional costs like property taxes, maintenance, and insurance, so make sure you’re financially prepared.

· Renting Pros: Flexibility, fewer upfront costs, no maintenance responsibilities.

· Buying Pros: Building equity, potential tax benefits, freedom to customize.

Consider your long-term plans, job stability, and local real estate market before deciding.

I rented for years before buying my first home, which allowed me to save for a larger down payment and find the right property.

Pro Tip: Use online calculators like those on Zillow or Bankrate to compare the costs of renting vs. buying in your area.

9. Not Investing in Personal Development: Your Greatest Asset is You

While building financial wealth is essential, investing in yourself is just as crucial. Your 20s are the perfect time to focus on personal development—acquiring new skills, education, and experiences that will pay dividends throughout your life. Ignoring this aspect of growth can limit your potential and hinder your long-term success.

A. Importance of Skills and Education:

In today’s fast-paced world, the skills and knowledge you have are your most valuable assets. Investing in your education—whether through formal schooling, online courses, or certifications—can significantly boost your earning potential and career opportunities. The more skills you acquire, the more versatile and valuable you become in the job market.

Personal development isn’t just about formal education, though. It’s also about cultivating soft skills like communication, leadership, and problem-solving. These skills are critical in almost every field and can set you apart from your peers, opening doors to promotions and new career paths.

Here’s why you should invest in your skill and education:

· Career Advancement: New skills can lead to promotions and higher pay.

· Adaptability: In a rapidly changing job market, continuous learning is crucial.

· Personal Fulfillment: Learning keeps life interesting and rewarding.

B. Cost-Effective Ways to Invest in Yourself:

You don’t need to spend a fortune to invest in personal development. Many online platforms offer affordable or even free courses on a wide range of subjects. Websites like Coursera, Udemy, and LinkedIn Learning provide access to high-quality education from top institutions at a fraction of the cost of traditional schooling.

Reading is another cost-effective way to expand your knowledge. Books, blogs, and podcasts are rich sources of information and can provide valuable insights into personal finance, business, and self-improvement.

Finally, don’t underestimate the value of networking. Building relationships with mentors, peers, and industry professionals can provide guidance, support, and opportunities for growth. Attend workshops, conferences, and networking events to connect with others in your field and learn from their experiences.

Take note of the key points:

1. Take online Courses: Platforms like Coursera, LinkedIn Learning, edX, or Udemy offer affordable options.

2. Read Widely: Books are a low-cost way to gain knowledge and perspectives.

3. Attend Workshops and Conferences: Great for learning and networking.

4. Find a Mentor: Their experience can be invaluable for your growth.

Investing in personal development is one of the smartest financial decisions you can make. It doesn’t just enhance your earning potential but also enriches your life, equipping you with the tools and knowledge needed to navigate the challenges and opportunities that lie ahead.

I’ve made it a habit to read at least one non-fiction book a month and take an online course each quarter. This consistent investment in myself has paid dividends in my career and personal life.

Pro Tip: Many public libraries offer free access to online learning platforms like LinkedIn Learning. Take advantage of these resources!

10. Failing to Set Financial Goals: Your Roadmap to Success

Without clear financial goals, you’re like a ship without a compass—drifting aimlessly and missing out on opportunities to build wealth and security. Setting financial goals gives you direction and purpose, helping you make informed decisions that align with your long-term vision.

A. Why Financial Goals Matter:

Financial goals are the foundation of any sound financial plan. They give you something to strive for, whether it’s saving for a down payment on a house, building an emergency fund, or planning for retirement. Having financial goals provides you:

· Direction: Goals give you a clear path to follow in your financial journey.

· Motivation: Having specific targets keeps you focused and motivated.

· Measurability: Goals allow you to track your progress and celebrate wins.

I remember floating through my early 20s without clear financial goals. Once I set specific targets, my financial life transformed dramatically.

B. How to Set and Track Financial Goals:

Setting financial goals doesn’t have to be complicated. Start by identifying what you want to achieve in the short, medium, and long term. Short-term goals might include paying off credit card debt or saving for a vacation, while long-term goals could involve buying a home or retiring comfortably.

Once you’ve identified your goals, break them down into specific, measurable, attainable, relevant, and time-bound (SMART) objectives. For example, instead of saying, “I want to save more money,” set a goal to “save $5,000 for an emergency fund within 12 months.”

Here’s a quick snapshot:

- Make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

- Write them down: Studies show you’re more likely to achieve written goals.

- Break them into smaller milestones: This makes big goals less overwhelming.

- Review regularly: Check your progress monthly or quarterly.

- Adjust as needed: Life changes, and your goals can too.

Tracking your progress is just as important as setting the goal itself. Use budgeting apps or spreadsheets to monitor your income, expenses, and savings. Regularly review your progress and make adjustments as needed. Celebrate your achievements along the way to stay motivated and keep your financial plan on track.

Pro Tip: Use apps like Mint or Personal Capital to set and track your financial goals. They can link to your accounts and give you real-time updates on your progress.

Conclusion: Your Financial Future Starts Now

As you navigate your 20s, the financial decisions you make today will shape your future for decades to come. By avoiding common mistakes like neglecting to budget, accumulating high-interest debt, and ignoring retirement savings, you can set yourself up for long-term success. Remember, it’s not about being perfect—it’s about making informed choices and learning from any missteps along the way.

A. Recap of Key Mistakes to Avoid:

- Not creating a budget: Without a budget, it’s easy to lose control of your finances.

- Neglecting to build an emergency fund: A safety net can protect you from unexpected expenses.

- Accumulating high-interest debt: Avoid credit card debt and manage existing debt wisely.

- Ignoring retirement savings: Start saving early to harness the power of compound interest.

- Living beyond your means: Keep lifestyle inflation in check and live within your means.

- Not investing early: The sooner you invest, the more time your money has to grow.

- Neglecting to build credit: A good credit score is essential for financial stability.

- Overspending on housing: Stick to the 30% rule and weigh the rent vs. buy decision carefully.

- Not investing in personal development: Invest in skills and education to boost your earning potential.

- Failing to set financial goals: Clear goals give you direction and purpose in your financial journey.

B. Encouragement for Taking Control of Finances Early:

Your 20s are a time of incredible opportunity. By avoiding these common financial mistakes, you’re not just saving yourself from future headaches – you’re setting the stage for a life of financial freedom and choice.

Remember, it’s not about being perfect. It’s about making conscious decisions and learning from your mistakes. Every step you take towards financial responsibility in your 20s compounds over time, just like a good investment.

I’ve seen firsthand how these principles can transform financial futures. It’s never too late to start, but the sooner you begin, the more options you’ll have down the road.

So, take that first step. Whether it’s creating a budget, opening a retirement account, or setting your first financial goal – start today. Your future self will thank you.

FAQs: Common Questions About Financial Management in Your 20s

Is it better to pay off debt or save for retirement?

It depends on the interest rate of your debt and your retirement plan’s returns. Generally, prioritize high-interest debt but don’t neglect retirement savings, especially if your employer offers a match.

How much should I save each month?

Aim to save at least 20% of your income. Start by building an emergency fund, then focus on retirement savings and other financial goals.

How much should I have saved by 30?

Aim for 1x your annual salary saved for retirement by 30. Also, try to have 3-6 months of expenses in an emergency fund.

Is it better to rent or buy a home in my 20s?

It depends on your personal circumstances. Consider your job stability, local real estate market, and long-term plans. Renting offers flexibility, while buying builds equity.

How can I start investing with little money?

Start with micro-investing apps like Acorns or Stash, or use robo-advisors like Betterment. Many allow you to start with just a few dollars.

How do I balance enjoying my 20s with saving for the future?

It’s all about balance. Budget for fun and experiences, but also for your future. The 50/30/20 rule can be a good starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

How can I improve my credit score?

Pay your bills on time, keep credit card balances low, and avoid opening too many new accounts. Regularly check your credit report for errors.What’s the best way to start investing? Start with low-cost index funds or ETFs, and consider using a robo-advisor if you’re new to investing. The key is to start early and invest consistently.

Should I rent or buy a home in my 20s?

Renting offers flexibility, while buying can be a good investment if you’re ready for the responsibility. Consider your financial situation, location, and long-term goals when making the decision.

Remember, financial management is a journey, not a destination. Keep learning, stay flexible, and don’t be afraid to seek advice when you need it. Your 20s are the perfect time to set the foundation for a lifetime of financial success.