How to Stop Living Paycheck to Paycheck: Proven Money-Saving Tips (My 2025 Guide)

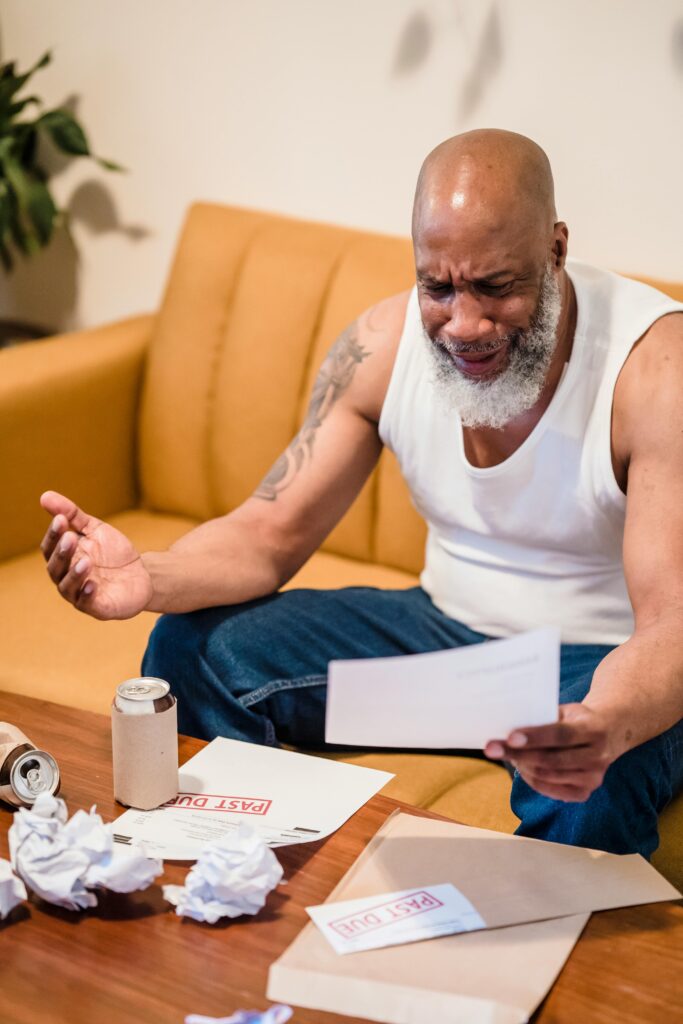

Living paycheck to paycheck isn’t just stressful – it’s like being stuck on a financial treadmill where you’re running hard but getting nowhere.

I know the rising costs of goods and services aren’t making things any easier. But whether you’re making $30,000 or $100,000 a year, the strategies I’m about to share have been battle-tested by real people who’ve transformed their financial lives. You don’t need a finance degree or a six-figure salary to stop living paycheck to paycheck – you just need a solid plan and the right mindset. Before we dive into the strategies, let’s understand exactly what it means to live paycheck to paycheck.

What is Living Paycheck to Paycheck? The Reality Check You Need

Let me break this down super simply: Living paycheck to paycheck means you’re spending everything you earn each month, with nothing left over. It’s like playing a game of financial Jenga – one wrong move and everything could come crashing down. You know that anxious feeling of watching your bank balance shrink after paying bills, hoping it’ll stretch until your next payday? That’s exactly what I’m talking about.

Here’s the shocking truth: according to a 2023 LendingClub report, nearly 64% of Americans were living paycheck to paycheck by the end of 2023. And guess what? It’s not just entry-level workers – I’ve seen executives making six figures who are just as trapped. The real kicker? Living paycheck to paycheck means one unexpected expense – a car repair, medical bill, or job loss – could throw your entire financial life into chaos.

But don’t worry – I’m about to show you how to break free from this cycle, no matter your income level.

1. Understand Your Financial Situation

You know what’s crazy? Most people have no idea where their money actually goes. I was the same way until I had my own financial wake-up call. Let’s change that for you today.

Track Your Spending Habits

As I always say: you can’t fix what you don’t measure. Think of your finances like a leaky bucket – before you can patch the holes, you need to find them. Here’s my simple three-step system for tracking your spending:

- Download a budgeting app (I personally love PocketGuard or Mint – they’re both free and super user-friendly)

- Connect your bank accounts and credit cards

- Review your spending daily for the first month (it takes just 5 minutes!)

Here’s a breakdown of how most people think they spend vs. how they actually spend:

| Category | Perceived Spending | Actual Spending | Reality Gap |

| Food & Dining | $400/month | $750/month | +$350 |

| Entertainment | $200/month | $450/month | +$250 |

| Shopping | $300/month | $600/month | +$300 |

| Transportation | $250/month | $400/month | +$150 |

Evaluate Financial Pitfalls

Let me share something personal – my biggest money leak used to be food delivery apps. I thought I was spending maybe $200 a month, but when I actually tracked it? YIKES. It was closer to $600! Here are the most common financial pitfalls I see:

- Subscription services you forgot about

- Impulse purchases (especially online shopping)

- Convenience fees and bank charges

- “Small” daily purchases that add up fast

Understand Fixed vs. Variable Expenses

Here’s the deal – your expenses fall into two camps. Fixed expenses are like your rent or car payment – they stay the same each month. Variable expenses are like groceries or entertainment – they change month to month. This distinction is crucial for building a better budget.

2. Master Budgeting Strategies

Now that you know where your money’s going, it’s time to tell it where to go instead. I’m about to share the exact strategies that helped me break free from living paycheck to paycheck.

The 50/30/20 Budgeting Rule

This is my favorite budgeting strategy because it’s simple and actually works. Here’s how I break it down:

- 50% for Needs: Housing, utilities, groceries, basic transportation

- 30% for Wants: Entertainment, dining out, shopping, hobbies

- 20% for Savings/Debt: Emergency fund, retirement, debt payoff

Pro Tip: If you’re serious about breaking the paycheck-to-paycheck cycle, try pushing more into the savings category – even 5% more can make a huge difference.

Envelope Budgeting System

I know what you’re thinking – “Who uses cash anymore?” But hear me out. The envelope system works because it makes your spending REAL. Here’s how I modernized it:

- Create separate digital “envelopes” in your banking app

- Divide your paycheck into these categories immediately

- Once an envelope is empty, that’s it for the month

Tips for Living on a Tight Budget

Living on a tight budget doesn’t mean living a boring life – trust me! Here are my favorite creative ways to save:

- Use cash back apps for everything (I earned $427 last year just from Ibotta)

- Join local Buy Nothing groups on Facebook

- Learn to cook your favorite takeout meals at home

- Find free entertainment in your city (I was shocked at how many free concerts my city offers!)

Remember, budgeting isn’t about restriction – it’s about freedom. When you tell your money where to go instead of wondering where it went, you’re taking the first step toward financial independence. Start with tracking everything for just one week – I promise you’ll discover something surprising about your spending habits!

3. Build Financial Security

Listen, I learned this the hard way – financial security isn’t just about having a fat paycheck. It’s about building a safety net that lets you sleep at night. Let me show you how.

Start an Emergency Fund

You know what’s worse than living paycheck to paycheck? Having an unexpected $500 car repair send you into a financial tailspin. Here’s my proven method for building your emergency fund:

| Emergency Fund Level | Target Amount | Timeline | Weekly Savings Needed |

| Starter Fund | $1,000 | 3 months | $83 |

| Basic Safety Net | $3,000 | 6 months | $125 |

| Full Emergency Fund | 6 months expenses | 12-18 months | $250+ |

Pro Tip: I started by saving just $25 a week. It felt tiny, but within a year, I had my first $1,000 safety net. Start small, but START.

Plan for Financial Goals

Here’s something I tell everyone – your financial goals need to be SMART (Specific, Measurable, Achievable, Relevant, Time-bound). Let me share what worked for me:

- Short-term goals (3-12 months): Build $1,000 emergency fund

- Medium-term goals (1-3 years): Pay off credit card debt

- Long-term goals (3+ years): Save for down payment on a house

Avoid Lifestyle Inflation

This is a big one! I once counseled someone who told me that when he got his first raise, he immediately upgraded his apartment. BIG mistake. Here’s how to avoid this trap:

- Bank your raises – pretend they don’t exist

- Wait 30 days before any lifestyle upgrades

- Focus on increasing your net worth, not your spending

4. Reduce Debt and Monthly Expenses

Ready for some serious money-saving moves? I’m about to share strategies that helped me cut my monthly expenses by over $800.

Pay Down Debt Strategically

Here’s the debt-killing strategy that worked wonders for me:

| Debt Type | Interest Rate | Monthly Payment | Strategy |

| Credit Cards | 15-25% | Maximum possible | Pay first |

| Personal Loans | 10-15% | Above minimum | Pay second |

| Car Loans | 4-8% | Regular payment | Pay third |

| Student Loans | 3-7% | Regular payment | Pay fourth |

Negotiate Bills and Subscriptions

You wouldn’t believe how much money you can save just by asking! Last month, I helped a friend save $143 on their cable bill with one phone call. Try these scripts:

“I’ve been a loyal customer for X years, and I noticed new customers are getting better rates. What can you do to help me?”

“I’m considering switching providers due to cost. What retention offers do you have available?”

Strategies for Reducing Monthly Expenses

Let me share my favorite money-saving hacks that actually work:

- Switch to a cheaper cell phone plan (I saved $45/month with Mint Mobile)

- Use smart power strips to reduce phantom energy costs

- Meal prep to cut grocery bills (I saved $320/month!)

- Bundle insurance policies (saved me 23% annually)

Remember – saving money isn’t about depriving yourself. It’s about being smarter with your choices. Start with one expense category this week. Challenge yourself to find creative ways to reduce it. You might be surprised at how easy it is once you get started!

Here’s something I tell my budget coaching clients: track your wins, no matter how small. Did you save $5 on coffee this week? That’s $260 a year! These small victories add up to major financial transformation over time.

5. Boost Your Income

Let’s get real – cutting expenses is great, but there’s a limit to how much you can cut. That’s why I’m obsessed with helping clients find ways to earn more. Here’s what actually works.

Start a Side Hustle

I started my own side hustle three years ago, and it now brings in an extra $1,200 monthly. Here are today’s most profitable side hustles:

| Side Hustle | Potential Monthly Income | Time Investment | Startup Costs |

| Freelance Writing | $500-$3,000 | 10-20 hrs/week | $0 |

| Online Tutoring | $800-$2,500 | 12-15 hrs/week | $0-$100 |

| Virtual Assistant | $1,000-$3,000 | 15-25 hrs/week | $0-$200 |

| Digital Marketing | $1,500-$4,000 | 15-30 hrs/week | $100-$500 |

| YouTube Content Creation | $100-$10,000+ | 20-40 hrs/week | $500-$2,000 |

Notice that YouTube’s potential income range is quite wide since earnings depend heavily on factors like subscriber count, views, and monetization strategies. The startup costs account for basic equipment like a good camera, microphone, and video editing software. The time investment includes content planning, filming, editing, thumbnail creation, and community engagement.

Pro Tip: Start with skills you already have. My first side gig was building Excel dashboards – something I did in my day job anyway!

Check out our post on: 5 Best Side Hustles That’ll Actually Make You Money in 2025

Leverage Your Skills

You’re probably sitting on valuable skills right now. Here’s how to monetize them:

- Turn your Excel skills into freelance data analysis

- Use your social media knowledge for small business management

- Convert your hobby (like photography or gaming) into a YouTube channel

- Package your professional experience into consulting services

Automate Your Finances

This is the game-changer most people miss. Here’s my automated money system:

- Paycheck hits account

- Automatic transfer to emergency fund (10%)

- Bill payments scheduled (50%)

- Investment contributions (15%)

- Fun money remains (25%)

6. Strengthen Financial Literacy

I’ll be honest – I used to think financial literacy was boring. But it’s literally the key to building wealth. Let me show you how to make it actually interesting.

Importance of Financial Planning

Think of financial planning like GPS for your money. Here’s my simple framework:

| Time Horizon | Financial Goal | Action Steps | Monthly Target |

| 6 months | Emergency Fund | Auto-save | $200 |

| 1 year | Debt Freedom | Debt Snowball | $400 |

| 5 years | Home Down Payment | Investment Account | $500 |

| 30 years | Retirement | 401(k)/IRA | $750 |

Credit Card Debt Management

LISTEN – this is crucial. Here’s what I wish someone had told me about credit cards:

- Never carry a balance (interest rates were insane in 2024)

- Use cards for points/cashback only

- Set up automatic payments for the full balance

- Keep utilization under 30%

Pro Tip: I put all my fixed expenses on a rewards card and pay it off automatically each month. Last year, I earned $842 in cashback just from regular spending!

Impact of Inflation on Budgeting

Inflation is hitting hard, but here’s how I’m staying ahead:

- Focus on increasing income to outpace inflation

- Invest in assets that typically beat inflation

- Review and adjust your budget quarterly

- Build price increases into your savings goals

Remember this: financial literacy isn’t about knowing everything – it’s about knowing enough to make smart decisions. Start with one concept at a time. I spent 15 minutes every morning learning about finance, and within a year, I felt more confident than ever about my money decisions.

Your homework? Pick ONE thing from this section and implement it this week. Whether it’s starting a side hustle or setting up automatic savings – take action now. Future you will be so grateful you did!

Conclusion: Your Path to Financial Freedom

Look, I get it – breaking free from the paycheck-to-paycheck cycle might feel overwhelming right now. But remember what we’ve covered: it’s not about making dramatic changes overnight. It’s about taking small, consistent steps toward financial freedom.

I’ve seen countless people transform their financial lives using these exact strategies. Start with tracking your spending, build that emergency fund (even if it’s just $25 a week), and gradually work your way through each step we’ve discussed. Remember – every financial expert started exactly where you are now.

Your financial freedom journey starts today. Which strategy will you implement first?

Frequently Asked Questions

What is the best way to stop living paycheck to paycheck?

Start by tracking all expenses and creating a realistic budget. Focus on building an emergency fund while simultaneously reducing unnecessary expenses. Remember, it’s a process – not an overnight fix.

How much should I save in an emergency fund?

Aim for 3-6 months of living expenses. But start with a mini-goal of $1,000 to handle unexpected costs. As we discussed earlier, even saving $25 weekly adds up to significant protection over time.

What budgeting method works best for beginners?

The 50/30/20 rule is perfect for beginners because it’s simple and flexible. Allocate 50% to needs, 30% to wants, and 20% to savings and debt repayment. Adjust these percentages based on your specific situation.

Quick Reference Guide

| Financial Goal | First Step | Timeline | Success Indicator |

| Emergency Fund | Save $1,000 | 3 months | Peace of mind |

| Debt Freedom | List all debts | 1-2 years | Improved credit score |

| Budgeting | Track expenses | 1 month | Clear spending patterns |

| Income Growth | Start side hustle | 6 months | Extra monthly income |

Take Action Now!

Ready to break free from the paycheck-to-paycheck cycle? Here’s your action plan:

- Download a budgeting app TODAY

- Set up your first automated savings transfer (even if it’s just $10)

- Review your expenses and identify one area to cut back

- Choose a side hustle to explore this week

Remember, financial freedom isn’t a destination – it’s a journey. And you’ve already taken the first step by reading this guide. I’d love to hear about your progress! Drop a comment below sharing which strategy you’re implementing first, or join our free Facebook community where we share daily tips and support.

Want more personalized guidance? Sign up for my weekly newsletter where I share exclusive money-saving tips, side hustle opportunities, and financial insights that I don’t publish anywhere else.

Your future self will thank you for starting today. Let’s make 2025 the year you finally break free from living paycheck to paycheck!