How to Manage Your Money Like the Top 1%: Proven Wealth-Building Strategies and Financial Habits

Ever wondered why some people seem to effortlessly build wealth while others struggle paycheck to paycheck? I’ve spent years studying the financial habits of the rich, and here’s the truth that might surprise you: it’s not about how much you earn—it’s about how you manage your money.

The top 1% didn’t get there by accident. They follow specific money management practices and wealth-building strategies that anyone can learn and apply. The beautiful thing about wealth? It doesn’t discriminate based on your starting point—only your willingness to adopt the right habits.

In this guide, I’ll share the exact financial planning strategies the wealthy use to build and protect their fortunes. You’ll discover proven investment strategies, learn budgeting tips for success, and understand the powerful mindset shifts that separate the financially free from the financially stressed.

Ready to transform your relationship with money? Let’s dive into the secrets of how to grow wealth like the top 1%.

1. The Wealth Mindset: How the Top 1% Think About Money

Here’s something that completely shifted my perspective on wealth: the rich don’t just have more money—they think about money COMPLETELY differently than everyone else. I’ve noticed this pattern again and again when studying successful investors and entrepreneurs.

Financial Discipline and Wealth: The Foundation of Success

The top 1% treat money like a tool, not an emotion. While most people make financial decisions based on feelings—fear, excitement, instant gratification—wealthy individuals approach every dollar with financial discipline and wealth-building in mind.

I remember reading about Warren Buffett still living in the same house he bought in 1958 for $31,500. That’s not being cheap—that’s understanding the difference between assets and liabilities. Best money management practices start with this fundamental shift in thinking.

Pro Tip: Before making any purchase over $100, ask yourself: “Will this make me money, save me money, or improve my earning potential?” If the answer is no, wait 24 hours before buying.

Long-Term Focus vs. Short-Term Spending

The wealthy play a different game entirely. While others focus on monthly budgets, they think in decades. This long-term perspective changes EVERYTHING about how they handle money.

| Average Person Mindset | Top 1% Mindset |

| “I need that new car payment” | “I need that compound interest working” |

| “I deserve this vacation” | “I deserve financial freedom” |

| “I’ll invest when I have more money” | “I’ll have more money because I invest” |

| “Debt is normal” | “Debt is expensive” |

Breaking Free From Common Money Traps

The biggest money trap I see people fall into? Living for today while ignoring tomorrow. The wealthy understand that every dollar spent on lifestyle inflation is a dollar NOT working for their future.

They avoid these common wealth killers:

- Lifestyle creep – Increasing expenses with income

- Emotional spending – Buying based on feelings

- Keeping up with appearances – Status purchases over investments

- Short-term thinking – Focusing on immediate wants over long-term needs

Now that you understand how the wealthy think about money, let’s build the practical foundation that turns this mindset into real wealth.

2. Building a Strong Financial Foundation

Think of your financial foundation like building a house. You wouldn’t start with the roof, right? Yet most people jump straight into investing without laying the groundwork. The top 1% ALWAYS build their foundation first.

Budgeting Tips for Success: Creating Your Wealth Blueprint

I used to think budgeting was boring until I realized it’s actually your wealth blueprint. The wealthy don’t budget to restrict themselves—they budget to optimize every dollar for maximum wealth building.

Creating a Simple But Powerful Budget

Your budget should answer one question: “How can I allocate my money to build the most wealth?” Here’s the system I’ve seen work consistently:

Step 1: Track your current spending for one month (yes, every coffee and subscription) Step 2: Categorize expenses into needs, wants, and wealth-builders Step 3: Implement the proven allocation system below

Tracking Income and Expenses Like the Wealthy

The rich track their money obsessively, but not in the way you might think. They don’t count pennies—they track money flow patterns. Where does money come from? Where does it go? What generates the highest returns?

Pro Tip: Use the 80/20 rule for expense tracking. Focus on the 20% of expenses that eat up 80% of your budget—usually housing, transportation, and food.

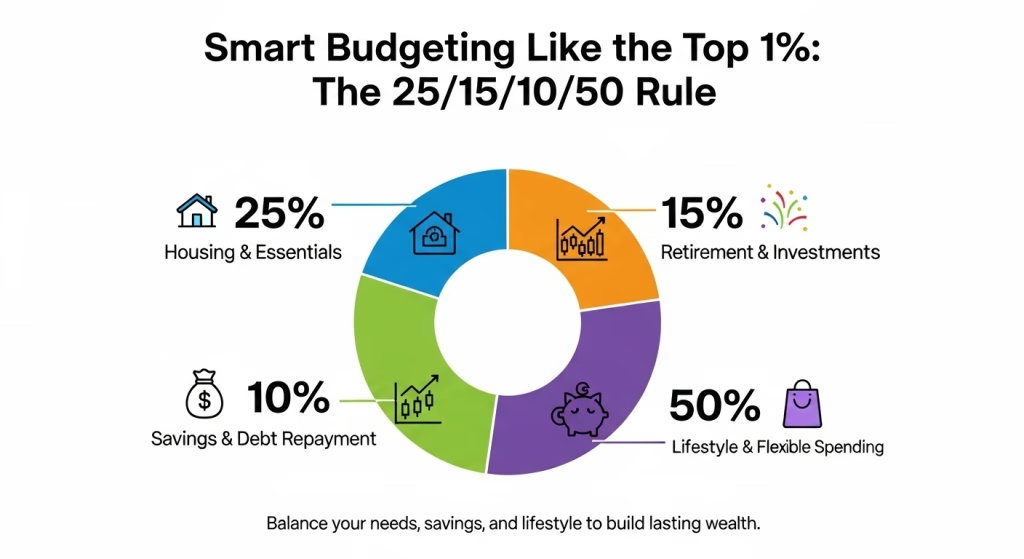

The 25/15/10/50 Rule of Money Management

After studying dozens of wealthy individuals, I discovered they follow similar allocation principles. Here’s the formula that consistently builds wealth:

| Category | Percentage | Purpose |

| Housing & Essentials | 25% | Keep fixed costs low |

| Retirement & Investments | 15% | Build long-term wealth |

| Savings & Debt Repayment | 10% | Financial security buffer |

| Lifestyle & Flexible Spending | 50% | Everything else |

Why this works: By keeping essentials at 25%, you free up massive amounts for wealth building. Most people spend 40-50% on housing alone, leaving nothing for investments.

Money Saving Techniques: Automation is Everything

The wealthy don’t rely on willpower—they rely on systems. Every successful person I know has automated their wealth building.

Automating Savings: Set It and Forget It

Set up automatic transfers on payday:

- Emergency fund: $500-1000 monthly until you hit 6 months of expenses

- Investment accounts: 15% of gross income, no exceptions

- Goal-specific savings: Vacation, car replacement, house down payment

Paying Yourself First: The Ultimate Wealth Hack

This changed my financial life: pay your future self BEFORE you pay anyone else. The wealthy understand that if you wait until the end of the month to save, there’s never anything left.

Pro Tip: Increase your automated savings by 1% every time you get a raise. You’ll never miss money you never see.

Emergency Funds: Why the Rich Never Ignore Them

Here’s what might surprise you: wealthy people keep MORE cash on hand, not less. They understand that cash isn’t just for emergencies—it’s for opportunities.

When the stock market crashes, the wealthy buy. When real estate prices drop, they invest. When businesses struggle, they acquire. But this only works if you have the cash ready.

Target Emergency Fund:

- Minimum: 3-6 months of expenses

- Optimal: 6-12 months for entrepreneurs or commission-based income

- Keep it accessible: High-yield savings account, NOT investments

With your mindset shifted and foundation solid, you’re ready for the wealth-building strategies that separate the top 1% from everyone else.

3. Proven Wealth-Building Strategies Used by the 1%

Now we’re getting to the good stuff! After your foundation is rock-solid, it’s time to implement the wealth-building strategies that actually move the needle. I’ve studied millionaires for years, and they ALL follow these core principles.

Wealth Building Strategies Explained Step by Step

The wealthy don’t just save money—they systematically build wealth machines. Here’s the progression I’ve seen work time and time again:

Phase 1: Foundation Building (Months 1-12)

- Build emergency fund to 6 months expenses

- Eliminate high-interest debt (credit cards, personal loans)

- Max out employer 401(k) match (free money!)

- Open high-yield savings account

Phase 2: Wealth Acceleration (Year 2+)

- Increase investment rate to 20%+ of income

- Diversify into index funds and ETFs

- Consider real estate investment

- Build multiple income streams

Pro Tip: Don’t try to skip Phase 1! I learned this the hard way when I started investing before eliminating my credit card debt. The 18% interest ate up all my investment gains.

How to Grow Wealth Steadily Over Time

Here’s what most people get wrong: they think wealth building is about hitting home runs. The reality? It’s about consistent singles and doubles over DECADES.

The wealthy understand the power of systematic wealth building:

| Strategy | Risk Level | Potential Return | Time Horizon |

| High-yield savings | Very Low | 4-5% | Any time |

| Index fund investing | Medium | 7-10% | 10+ years |

| Real estate | Medium-High | 8-12% | 5+ years |

| Business ownership | High | 15%+ | 3+ years |

Building Wealth Over Time With Compound Interest

Einstein allegedly called compound interest the eighth wonder of the world. Whether he said it or not, he was RIGHT. This is where the magic happens, and why starting early beats starting with more money.

Let me blow your mind with some numbers:

The Power of Starting Early:

- Sarah starts at 25: Invests $300/month until 35 (10 years, $36,000 total)

- Mike starts at 35: Invests $300/month until 65 (30 years, $108,000 total)

- At age 65: Sarah has $566,000, Mike has $679,000

Sarah invested ONE-THIRD the amount but nearly matched Mike’s total! That’s compound interest working its magic.

Pro Tip: Every year you wait to start investing costs you approximately $100,000 in retirement wealth. Stop waiting—start TODAY.

High-Income Money Management: Avoiding Lifestyle Inflation

Here’s the trap that catches almost everyone: as income goes up, lifestyle goes up even faster. I call this the “golden handcuffs” syndrome. The wealthy break this cycle by treating raises as wealth-building opportunities, not lifestyle upgrades.

The 50/30/20 Raise Rule:

- 50% to increased investments

- 30% to lifestyle improvement

- 20% to increased savings

This way, you enjoy some benefits from your hard work while ACCELERATING your wealth building.

Once you understand these strategies, the next step is putting your money to work through smart investments that compound over time.

4. Smart Investment Approaches That Build Wealth

Investment is where your wealth-building foundation transforms into serious money. But here’s what separates the wealthy from everyone else: they invest strategically, not emotionally.

How the Top 1% Invest Money

The wealthy don’t chase hot stock tips or try to time the market. They build diversified portfolios that weather any storm and grow consistently over time.

Diversification Across Assets: Don’t Put All Eggs in One Basket

Smart investors spread risk across multiple asset classes. Here’s the allocation strategy I’ve seen work consistently:

The Wealth-Builder’s Portfolio:

| Asset Class | Allocation % | Purpose | Examples |

| U.S. Stock Market | 40-50% | Growth engine | S&P 500 index funds |

| International Stocks | 20-30% | Global diversification | International index funds |

| Bonds | 10-20% | Stability & income | Treasury bonds, corporate bonds |

| Real Estate | 10-20% | Inflation hedge | REITs, rental properties |

| Alternative Assets | 5-10% | Diversification | Commodities, crypto (small %) |

Long-Term Growth vs. Speculation

The wealthy invest for decades, not days. They understand that time in the market beats timing the market every single time.

I learned this lesson when I tried day trading in 2020. Made some quick gains, got cocky, then lost it all in two bad weeks. Meanwhile, my boring index fund investments kept growing steadily.

Pro Tip: If you’re checking your investments daily, you’re doing it wrong. Set up automatic investing and check quarterly—maximum.

Investment Strategies for Beginners

Starting your investment journey doesn’t require a finance degree or thousands of dollars. The wealthy started simple, and so can you.

Index Funds and ETFs: The Smart Money’s Choice

Warren Buffett has recommended index funds more than any other investment. Why? They’re diversified, low-cost, and consistently beat 90% of actively managed funds over time.

My Top Beginner Recommendations:

- VTSAX (Vanguard Total Stock Market) – Owns entire U.S. stock market

- VTIAX (Vanguard Total International) – International diversification

- VBTLX (Vanguard Total Bond Market) – Stability component

Start with $1,000 minimum, then add $500 monthly. It’s that simple.

Real Estate as a Wealth Builder

Real estate has created more millionaires than any other investment class. But you don’t need $500,000 to start—REITs (Real Estate Investment Trusts) let you invest in real estate with just $100.

Real Estate Investment Options:

- REITs – Like mutual funds for real estate

- House hacking – Live in one unit, rent others

- Rental properties – Traditional landlording

- Real estate crowdfunding – Pool money with other investors

Passive Income Ideas the Wealthy Rely On

The ultimate goal? Money working harder than you do. The wealthy build multiple streams of passive income that flow even when they sleep.

Top Passive Income Streams:

- Dividend-paying stocks – Companies that share profits with shareholders

- Rental real estate – Tenants pay your mortgage plus profit

- Index fund distributions – Market growth compounds automatically

- Business investments – Partner in profitable businesses

- Royalties – Create once, earn forever (books, courses, patents)

Pro Tip: Aim to replace 25% of your working income with passive income within 5 years. Once you hit that milestone, you’ll never feel financially stressed again.

The Wealth-Building Timeline:

- Years 1-2: Build foundation, start investing 15%

- Years 3-5: Increase to 20%+, add real estate

- Years 5-10: Diversify income streams, optimize taxes

- Years 10+: Passive income covers lifestyle, work becomes optional

The beautiful thing about these strategies? They work regardless of your starting salary. It’s not about earning more—it’s about keeping more and making it multiply.

Ready to put this all together into a comprehensive financial plan that builds lasting wealth?

5. Personal Finance for Long-Term Security

Building wealth is just half the equation—protecting and growing it for the long haul is where the real magic happens. The wealthy don’t just make money; they create financial systems that work for generations.

Financial Planning for Individuals at Every Income Level

Here’s what I love about personal finance: the principles work whether you make $50,000 or $500,000. I’ve seen people earning modest salaries retire as millionaires because they understood these fundamentals early.

The key is scaling your strategy to your income level:

| Income Level | Primary Focus | Key Strategies | Target Savings Rate |

| $40K-70K | Foundation building | Emergency fund, 401(k) match, debt elimination | 15-20% |

| $70K-150K | Wealth acceleration | Max retirement accounts, index funds, house down payment | 20-25% |

| $150K+ | Wealth optimization | Tax-advantaged investing, real estate, business ownership | 25%+ |

Pro Tip: Your savings rate matters MORE than your salary. I know a teacher who retired at 55 with $1.2 million by consistently saving 30% of her income. Meanwhile, I’ve met lawyers making $300K who live paycheck to paycheck.

Wealth Management Advice for Long-Term Success

The wealthy think in terms of wealth preservation and wealth transfer. They’re not just building money for themselves—they’re creating generational wealth that lasts.

The Wealth Management Pyramid:

Level 4: Legacy Planning (Estate planning, trusts) Level 3: Tax Optimization (Advanced strategies)

Level 2: Wealth Growth (Diversified investments) Level 1: Foundation (Emergency fund, insurance, debt-free)

Most people focus only on Level 2, but the wealthy build from the bottom up and eventually master all four levels.

Managing Money for Financial Freedom

Financial freedom isn’t about having millions in the bank—it’s about having enough passive income to cover your lifestyle. The wealthy understand this distinction and plan accordingly.

Setting Financial Goals That Actually Work

I used to set vague goals like “get rich” or “save more money.” Total waste of time! The wealthy set specific, measurable, time-bound goals that drive real action.

SMART Financial Goals Framework:

- Specific: “Save $50,000 for rental property down payment”

- Measurable: Track progress monthly

- Achievable: Based on current income and expenses

- Relevant: Aligns with long-term wealth plan

- Time-bound: “By December 2026”

My Personal Goal-Setting System:

- 1-year goals: Emergency fund, debt elimination

- 5-year goals: House down payment, investment milestones

- 10-year goals: Financial independence number

- 25-year goals: Full retirement, legacy planning

Planning for Retirement Early: The Compound Interest Advantage

Starting early with retirement planning is THE most powerful wealth-building strategy. Every year you delay costs you exponentially more in the future.

The Retirement Reality Check:

| Starting Age | Monthly Investment | Total at 65 |

| 25 | $300 | $878,570 |

| 35 | $300 | $367,886 |

| 45 | $300 | $139,598 |

| 55 | $300 | $41,829 |

Same monthly amount, VASTLY different results. Time is your biggest asset—use it!

Pro Tip: If you can’t max out your 401(k) immediately, increase your contribution by 1% every year. You’ll barely notice the difference, but your future self will thank you.

Personal Finance for High Net Worth: Lessons Everyone Can Apply

Even if you’re not high net worth YET, you can adopt the strategies wealthy individuals use to optimize their finances.

Advanced Strategies You Can Start Today:

- Tax-loss harvesting – Offset gains with losses to reduce taxes

- Asset location – Put the right investments in the right accounts

- Roth conversions – Convert traditional IRA money during low-income years

- Backdoor Roth IRA – Contribute to Roth even with high income

These strategies become your financial habits, which brings us to the daily practices that separate the wealthy from everyone else.

6. Daily Financial Habits of the Rich

Success isn’t about occasional grand gestures—it’s about daily habits that compound over time. The financial habits of the rich aren’t glamorous, but they’re incredibly powerful.

Financial Habits of the Rich You Can Adopt Today

I’ve studied the daily routines of hundreds of wealthy individuals, and the patterns are remarkably consistent. They treat money management like a daily practice, not a monthly chore.

Tracking Net Worth Regularly: Your Financial Scorecard

The wealthy track their net worth like athletes track their performance. They know EXACTLY where they stand financially at all times.

Simple Net Worth Calculation: Assets (what you own) – Liabilities (what you owe) = Net Worth

Monthly Net Worth Tracking:

- Assets: Cash, investments, real estate, business equity

- Liabilities: Mortgage, credit cards, loans, other debts

- Trend: Is it growing month over month?

I check my net worth every month on the 1st. Takes 15 minutes, but it keeps me laser-focused on wealth-building decisions.

Pro Tip: Use free tools like Personal Capital or Mint to automate net worth tracking. When you see your progress visually, you stay motivated.

Prioritizing Assets Over Liabilities

Rich people buy assets that put money in their pocket. Poor people buy liabilities that take money OUT of their pocket. It sounds simple, but most people get this backwards.

Asset vs. Liability Examples:

| Assets (Money Makers) | Liabilities (Money Takers) |

| Rental real estate | Primary residence mortgage |

| Dividend-paying stocks | Car payments |

| Index funds | Credit card debt |

| Business ownership | Expensive watches/jewelry |

| High-yield savings | Boat/RV payments |

Every purchase decision should ask: “Does this make me money or cost me money?”

Continuous Learning About Money

The wealthy never stop learning. They read financial books, listen to podcasts, attend seminars, and constantly upgrade their money knowledge.

My Daily Learning Routine:

- Morning: 15 minutes reading financial news (Wall Street Journal, Morningstar)

- Commute: Money podcasts (The Investors Podcast, Chat with Traders)

- Evening: One financial book chapter (currently reading “The Intelligent Investor”)

Financial Independence Tips for Everyday People

Financial independence isn’t reserved for the ultra-wealthy. Regular people achieve it by following these daily practices:

The FI Daily Checklist:

- ✅ Check investment accounts (quick glance, no stress)

- ✅ Review daily spending (stay conscious of money flow)

- ✅ Look for optimization opportunities (better rate, lower fee, tax advantage)

- ✅ Automate one more financial process (reduce decision fatigue)

- ✅ Learn something new about money (compound your knowledge)

How Small Consistent Actions Create Big Wealth

Here’s the truth that changed my entire approach to money: small actions, done consistently, create exponential results. The wealthy understand this principle and live it daily.

The Power of 1% Daily Improvements:

If you improve your financial situation by just 1% every day:

- Week 1: 7% better

- Month 1: 37% better

- Year 1: 3,778% better!

Daily 1% Improvements:

- Negotiate one bill or subscription

- Learn about one new investment option

- Automate one more savings transfer

- Read one article about money management

- Review and optimize one expense category

Pro Tip: Don’t try to overhaul your entire financial life overnight. Pick ONE habit and master it for 30 days. Then add another. Sustainable change beats dramatic change every time.

The beautiful thing about these habits? They become automatic after a few months. You stop thinking about them—they just become part of who you are. And that’s when the real wealth building accelerates.

Your journey to financial freedom isn’t about perfection—it’s about progress. Every day you practice these habits, you move closer to the financial security and freedom you deserve.

Conclusion

Here’s the truth I wish someone had told me twenty years ago: managing your money like the top 1% isn’t about having millions to start with—it’s about developing the RIGHT habits and sticking to them consistently.

Throughout this guide, we’ve uncovered the exact wealth-building strategies and financial habits that separate the financially free from the financially stressed. You now know that the wealthy don’t just earn more—they think differently, save systematically, invest strategically, and build multiple income streams that work while they sleep.

The wealth mindset shift alone will transform how you see every dollar. When you start viewing money as a tool for building assets rather than funding lifestyle inflation, everything changes. The 25/15/10/50 budgeting rule gives you a proven framework that works at any income level. The investment strategies we discussed—from index funds to real estate—provide your roadmap to long-term wealth building.

But here’s what matters most: ACTION beats perfection every single time. You don’t need to implement everything at once. Start with ONE habit. Build your emergency fund. Automate your investments. Track your net worth monthly. These small steps compound into life-changing results.

The difference between financial struggle and financial freedom isn’t your starting salary—it’s the habits you choose TODAY. The wealthy became wealthy by doing what others won’t do consistently over time. Now you have their playbook.

Your future wealthy self is counting on the decisions you make right now. Don’t let them down.

Ready to start building wealth like the top 1%? Pick ONE strategy from this guide and implement it THIS WEEK. Your financial transformation starts with that first step.

Frequently Asked Questions (FAQs)

How do the top 1% manage their money differently?

The top 1% approach money management with systems rather than emotions. They automate their savings, diversify their investments across multiple asset classes, and focus on building assets that generate passive income. Unlike average earners who spend first and save what’s left, wealthy individuals pay themselves first through automatic transfers to investment accounts. They also track their net worth monthly and make financial decisions based on long-term wealth building rather than short-term gratification.

What are the best wealth-building strategies for beginners?

The most effective wealth-building strategies for beginners start with building a solid foundation. First, create an emergency fund of 3-6 months of expenses. Next, eliminate high-interest debt like credit cards. Then, start investing 15% of your income in low-cost index funds like VTSAX or target-date funds. Automate everything—your savings, investments, and bill payments. The key is consistency over perfection. Even investing $300 per month starting at age 25 can result in over $800,000 by retirement due to compound interest.

How can I start investing like the wealthy with a small income?

You don’t need thousands to start investing like the wealthy. Begin with just $100 per month in a diversified index fund. Many brokerages like Fidelity and Vanguard have no minimum investment requirements. Focus on broad market index funds (S&P 500), international funds, and bond funds for diversification. The wealthy prioritize consistent investing over timing the market. Set up automatic investments on payday so you never see the money—this removes the temptation to spend it elsewhere.

What financial habits do rich people practice daily?

Rich people practice several key daily habits: they track their spending and net worth religiously, prioritize buying assets over liabilities, and continuously educate themselves about money through books and podcasts. They review their investment accounts regularly but don’t make emotional trading decisions. Wealthy individuals also negotiate better deals on everything from insurance to subscriptions, and they automate as many financial processes as possible to reduce decision fatigue and ensure consistency.

How do I build passive income streams like the top 1%?

Building passive income streams requires initial effort that pays dividends forever. Start with dividend-paying stocks and index funds that distribute quarterly payments. Consider REITs (Real Estate Investment Trusts) for real estate exposure without being a landlord. If you have more capital, rental properties provide excellent passive income after the initial setup. Other options include creating digital products, writing books, or building businesses that can eventually run without your daily involvement. The goal is replacing 25% of your working income with passive income within 5 years.

What’s the biggest money mistake that prevents wealth building?

The biggest money mistake is lifestyle inflation—increasing spending whenever income increases. Most people spend their raises instead of investing them, which keeps them on the financial treadmill indefinitely. The wealthy follow the 50/30/20 raise rule: 50% to increased investments, 30% to modest lifestyle improvement, and 20% to increased savings. Another critical mistake is waiting to invest until you have “more money.” Time in the market beats timing the market, and starting early with small amounts beats starting late with large amounts due to compound interest.

How much should I save to become wealthy like the top 1%?

To build significant wealth, aim to save and invest 20-25% of your gross income. The top 1% typically save 30%+ of their income across various vehicles—401(k)s, IRAs, taxable investment accounts, and real estate. Use the 25/15/10/50 rule: 25% for housing and essentials, 15% for retirement and investments, 10% for savings and debt repayment, and 50% for everything else. If 20% seems impossible now, start with whatever you can manage and increase by 1% annually. Remember, your savings rate matters more than your income level for building long-term wealth.

We would like to hear from you: What do you think about these wealth-building strategies and financial habits of the top 1%? Have you implemented any of these techniques in your own financial journey? I’d love to hear about your experiences with budgeting, investing, or building passive income streams. Share your thoughts, questions, or success stories in the comment section—your insights might help other readers on their path to financial freedom!