6 Key Qualities You Need to Achieve True Financial Freedom (And How to Build Them)

Imagine that it’s Sunday morning, and instead of stressing about Monday’s bills, you’re sipping coffee and planning your next vacation. Sound like a fantasy? I used to think so too.

Listen, financial freedom isn’t about hitting the lottery or inheriting millions—it’s about developing the right qualities that millionaires have been using for decades.

Here’s the truth that took me years to learn: True financial freedom means having complete control over your money choices without depending on a paycheck to survive. It’s waking up knowing you can handle whatever life throws at you, whether that’s a job loss, medical emergency, or simply deciding to take a year off to travel the world.

But here’s where most people get it wrong—they think financial independence happens overnight or requires some secret formula. The reality? It’s built on six specific, learnable qualities that anyone can develop, regardless of their current income or background.

I’ve spent years studying financially free individuals, and I’ve discovered these aren’t personality traits you’re born with. They’re skills you can build starting TODAY. Whether you’re drowning in debt or just starting your wealth-building journey, these six qualities will transform how you think about and manage money.

Ready to discover what separates the financially free from those living paycheck to paycheck?

I. Self-Discipline: The Foundation of Wealth

Let me tell you something that might sting a little: Your biggest enemy on the path to financial freedom isn’t your boss, the economy, or even your current income—it’s your lack of self-discipline with money.

I learned this the hard way when I blew through a $3,000 bonus in just two weeks. Designer clothes, fancy dinners, gadgets I didn’t need. Sound familiar? That’s when I realized that without self-discipline, even winning the lottery won’t save you from financial disaster.

Why Discipline Matters in Money Management

Self-discipline with money means making decisions based on your future goals, not your current emotions. It’s choosing to invest $500 instead of buying that new gaming console. It’s meal prepping instead of ordering takeout for the fifth time this week.

Here’s what financial discipline looks like in action:

- Sticking to your budget even when your friends invite you to expensive dinners

- Paying yourself first by saving before you spend on anything else

- Avoiding impulse purchases by waiting 24 hours before buying non-essentials

- Tracking every expense so you know exactly where your money goes

The Real Cost of Poor Financial Discipline

Let me break down what undisciplined spending actually costs you:

| Bad Habit | Monthly Cost | Annual Cost | 10-Year Investment Value* |

| Daily $5 coffee | $150 | $1,800 | $25,000 |

| Weekly takeout ($40) | $160 | $1,920 | $26,700 |

| Impulse shopping ($200/month) | $200 | $2,400 | $33,300 |

| Total | $510 | $6,120 | $85,000 |

*Assuming 7% annual return

WHOA! That’s $85,000 you’re giving up over ten years. Suddenly that daily Starbucks run doesn’t seem so harmless, does it?

How to Build Self-Discipline with Money

Building financial self-discipline isn’t about depriving yourself—it’s about creating systems that make good choices automatic.

Start with the 24-Hour Rule Before making any non-essential purchase over $50, wait 24 hours. I promise you, half the things you “need” will lose their appeal by tomorrow. This simple trick has saved me thousands.

Use the Envelope Method Take cash for discretionary spending and put it in labeled envelopes: groceries, entertainment, personal care. When the envelope is empty, you’re done spending in that category. It’s impossible to overspend when there’s literally no money left.

Automate Your Success Set up automatic transfers to savings and investments the day after payday. You can’t spend money that’s already gone. I move 20% of my income to savings before I even see it.

Pro Tip: Start small with just 1% of your income going to savings, then increase by 1% each month. By month 20, you’ll be saving 20% without feeling the pinch.

II. Patience: Building Wealth Takes Time

Now, let’s talk about the quality that separates real wealth builders from get-rich-quick dreamers: patience.

I used to be the guy checking his investment app every five minutes, panicking when the market dipped, and jumping from one “hot stock tip” to another. Guess what happened? I lost money, lots of it. That’s when I learned that patience isn’t just a virtue—it’s a wealth-building superpower.

The Magic of Long-Term Thinking

Here’s something that’ll blow your mind: Time is more powerful than money when it comes to building wealth. Thanks to compound interest, every dollar you invest today works harder than dollars you’ll invest later.

Let me show you what I mean:

Sarah starts investing at 25: $200/month for 10 years, then stops Mike starts investing at 35: $200/month for 30 years straight

| Investor | Start Age | Monthly Investment | Years Invested | Total Invested | Value at 65* |

| Sarah | 25 | $200 | 10 years | $24,000 | $602,000 |

| Mike | 35 | $200 | 30 years | $72,000 | $566,000 |

*Assuming 8% annual return

Are you seeing this? Sarah invested $48,000 LESS but ended up with $36,000 MORE! That’s the incredible power of starting early and letting time do the heavy lifting.

Understanding Compound Interest

Einstein supposedly called compound interest “the eighth wonder of the world.” I call it the ultimate patience reward system.

Compound interest means you earn money on your money, then you earn money on THAT money. It starts slow, but after years, it explodes. Look at how $10,000 grows:

- Year 5: $14,693

- Year 10: $21,589

- Year 20: $46,610

- Year 30: $100,627

The first decade feels slow, but decades two and three? That’s where the magic happens.

Avoiding Get-Rich-Quick Traps

I’ve seen too many people destroy their financial futures chasing quick profits. Cryptocurrency day trading, penny stocks, multi-level marketing schemes—they all promise fast wealth and deliver fast losses.

Red flags to watch for:

- Promises of “guaranteed” high returns

- Pressure to “act now” or “limited time offers”

- Testimonials from people making “easy money”

- Complex strategies you don’t fully understand

How to Build Patience in Wealth Building

Create Visual Reminders I keep a chart showing my net worth growth over time on my wall. Seeing that upward trend, even with occasional dips, reminds me why I’m playing the long game.

Set Milestone Celebrations Don’t wait until you’re financially free to celebrate. Set smaller goals like your first $1,000 in savings, first $10,000 invested, or paying off a credit card. These victories keep you motivated during the long journey.

Focus on Systems, Not Outcomes Instead of obsessing over your account balance, focus on your habits. Are you contributing consistently? Are you learning about investing? Good systems create good outcomes.

Pro Tip: Calculate what your current savings rate will look like in 10, 20, and 30 years. Seeing those big future numbers makes it easier to skip today’s temptations.

The bottom line? Wealth building is a marathon, not a sprint. Those who understand this fundamental truth and have the patience to stick with their plan are the ones who ultimately achieve true financial freedom.

III. Financial Literacy: Knowledge is Power

Here’s a confession that might surprise you: I used to think a 401(k) was some kind of road race, and I had no clue what an index fund was until I was 28 years old.

Embarrassing? Absolutely. But I’m not alone. Studies show that only 57% of American adults are financially literate. That means nearly half of us are making major money decisions without understanding the basics. It’s like trying to perform surgery after watching a 5-minute YouTube video!

This financial ignorance costs us BIG TIME. I once paid 24% interest on a credit card for two years because I didn’t understand how compound interest worked against me. That mistake alone cost me over $3,000.

The Basics Everyone Should Master

Financial literacy isn’t about becoming a Wall Street expert—it’s about understanding the fundamentals that affect your daily life.

Essential Knowledge Areas:

- Interest rates: How they work for and against you

- Credit scores: What impacts them and why they matter

- Investment basics: Stocks, bonds, mutual funds, ETFs

- Tax fundamentals: Deductions, tax-advantaged accounts

- Insurance needs: What coverage you actually need

- Debt types: Good debt vs. bad debt

Understanding Debt: Your Frenemy

Not all debt is created equal. I used to think all debt was bad until I learned this game-changing distinction:

| Good Debt | Bad Debt |

| Mortgages (builds equity) | Credit cards (high interest, depreciating purchases) |

| Student loans (increases earning potential) | Car loans (depreciating asset) |

| Business loans (generates income) | Personal loans for vacations |

| Investment property loans (cash flow positive) | Payday loans (predatory rates) |

Here’s my rule: If debt helps you make more money or build wealth, it might be worth it. If it’s for stuff that loses value immediately, run away!

Investment Basics That Changed My Life

When I first started investing, I was overwhelmed by all the options. Then my mentor taught me this simple truth: “You don’t need to be smart, you just need to be consistent.”

The Big Four Investment Types:

- Stocks: You own a piece of companies (higher risk, higher potential return)

- Bonds: You’re lending money (lower risk, steady income)

- Index Funds: You own tiny pieces of hundreds of companies (diversified, low fees)

- Real Estate: Physical property or REITs (inflation hedge, potential rental income)

For beginners, I always recommend starting with low-cost index funds. They’re like buying the entire stock market in one purchase. Simple, effective, and historically profitable.

How to Build Financial Literacy

Start with the 20-Minute Rule Spend just 20 minutes daily learning about money. Read financial blogs, watch YouTube videos, or listen to podcasts during your commute. In six months, you’ll know more than 80% of people.

Follow the 3-2-1 Learning Method

- 3 financial podcasts in your rotation

- 2 finance books per year minimum

- 1 financial news source you check weekly

Practice with Play Money Use apps like Investopedia’s stock simulator to practice investing with fake money before risking real cash. I wish I’d done this before losing $1,200 on a “sure thing” stock tip.

Pro Tip: Every time you learn a new financial concept, explain it to someone else within 24 hours. If you can’t explain it simply, you don’t understand it well enough.

IV. Cash Flow Management: Control Your Money Like a Pro

Moving from financial literacy to cash flow management is like upgrading from knowing how to drive to actually navigating rush-hour traffic. This is where theory meets reality, and where most people crash and burn.

I learned this lesson when I was making $75,000 a year but somehow always felt broke. My problem wasn’t income—it was cash flow management. I had no idea where my money went each month.

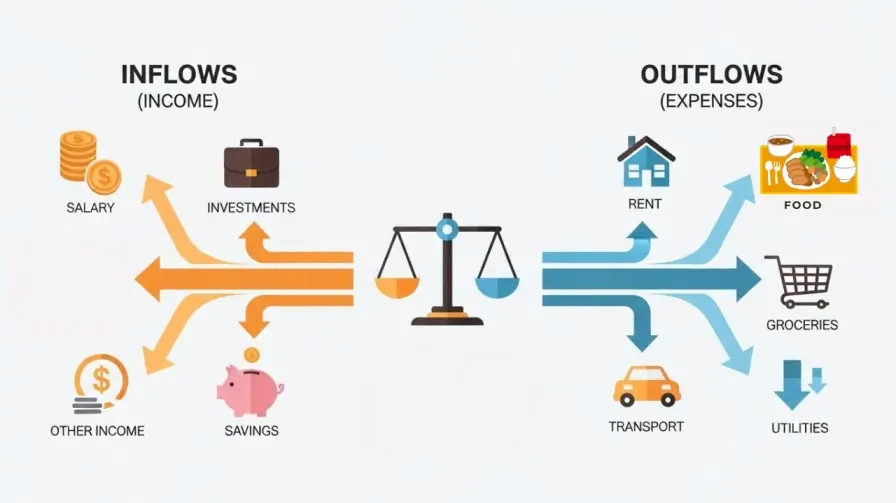

The Cash Flow Fundamentals

Cash flow is simply money coming in minus money going out. Sounds basic, right? But here’s what trips up most people: positive cash flow doesn’t automatically mean you’re building wealth.

You could have $500 left over each month but if it’s sitting in a checking account earning 0.01% interest, you’re actually losing money to inflation.

The Cash Flow Hierarchy:

- Survival: Essential expenses (housing, food, utilities)

- Security: Emergency fund and insurance

- Growth: Investments and wealth building

- Lifestyle: Entertainment and discretionary spending

Most people do this backwards—they spend on lifestyle first, then wonder why they can’t save.

Tracking Income vs. Expenses

Here’s my bulletproof system for managing cash flow:

The 50/30/20 Rule (My Modified Version):

| Category | Percentage | What It Includes |

| Needs | 50% | Rent, utilities, groceries, minimum debt payments |

| Investments | 20% | 401(k), IRA, taxable accounts, emergency fund |

| Wants | 30% | Entertainment, dining out, hobbies, extra debt payments |

But here’s my twist: I flip the traditional order. I pay my investments FIRST (that 20%), then cover needs, then whatever’s left goes to wants. This ensures wealth building isn’t an afterthought.

Avoiding Negative Cash Flow Traps

Negative cash flow is like quicksand—the longer you stay in it, the harder it becomes to escape. Here are the biggest traps I see:

Lifestyle Inflation: Every raise becomes an excuse to spend more The Subscription Trap: $10 here, $15 there adds up to hundreds monthly

Credit Card Float: Using credit cards to make up cash flow shortfalls Emergency Fund Raids: Constantly dipping into savings for “emergencies”

How to Improve Cash Flow Management

Use the Bucket System I have different accounts for different purposes:

- Checking: Monthly expenses only

- High-yield savings: Emergency fund

- Investment accounts: Long-term wealth building

- “Fun money” account: Guilt-free spending

This separation makes it impossible to accidentally spend investment money on pizza.

Implement Zero-Based Budgeting Every dollar gets a job before the month starts. Income minus all planned expenses and savings should equal zero. This forces you to be intentional with every penny.

The Cash Flow Review Ritual Every Sunday, I spend 15 minutes reviewing:

- Last week’s spending vs. budget

- Upcoming week’s planned expenses

- Any cash flow adjustments needed

Pro Tip: Use the “Pay Yourself First” automation. Set up automatic transfers to savings and investments on payday. You can’t spend money you never see.

Remember, cash flow management isn’t about restriction—it’s about intention. When you control your cash flow, you control your financial destiny.

V. Adaptability: Adjusting to Life’s Changes

Life has a funny way of throwing curveballs when you least expect them. In 2020, I learned this lesson the hard way when the pandemic wiped out 40% of my consulting income overnight.

But here’s what separated me from friends who panicked and made devastating financial decisions: I had built adaptability into my financial plan. While others were scrambling, I was pivoting. This quality literally saved my financial future.

Adaptability isn’t just nice to have—it’s absolutely critical for long-term financial success. The economy changes, industries evolve, personal circumstances shift. Those who can roll with the punches don’t just survive; they thrive.

Managing Unexpected Expenses and Emergencies

Let’s be real: emergencies aren’t “if” situations—they’re “when” situations. Your car will break down. Medical bills will appear. Job losses happen. The question isn’t whether these things will occur, but whether you’ll be ready.

My Emergency Fund Evolution:

| Emergency Level | Fund Size | What It Covers |

| Starter Emergency | $1,000 | Minor car repairs, small medical bills |

| Basic Security | 3 months expenses | Job loss, major repairs |

| Full Protection | 6 months expenses | Extended unemployment, major life changes |

| Ultimate Peace of Mind | 12 months expenses | Economic downturns, career transitions |

I started with just $500 in emergency savings. Every month, I added $100 until I hit my target. It took time, but that fund has saved me from going into debt at least five times.

The Adaptability Mindset in Action:

When my income dropped in 2020, I didn’t panic. Instead, I:

- Cut non-essential expenses immediately (goodbye, $200 cable bill)

- Negotiated payment plans with creditors

- Pivoted my skills to online consulting

- Started a side hustle teaching financial literacy

Creating Multiple Income Streams

Here’s something that changed my entire financial outlook: relying on one income source is like putting all your eggs in one very fragile basket.

Diversifying income isn’t just for entrepreneurs—it’s for anyone who wants true financial security. The goal isn’t to work 80-hour weeks; it’s to create systems that generate money even when you’re sleeping.

Income Stream Categories:

- Active Income: Your day job, freelancing, consulting

- Portfolio Income: Dividends, interest, capital gains

- Passive Income: Rental properties, royalties, automated businesses

- Side Hustles: Part-time work, online selling, gig economy

My Personal Income Evolution:

| Year | Primary Income | Side Income | Investment Income | Total Streams |

| 2018 | 100% | 0% | 0% | 1 |

| 2020 | 75% | 20% | 5% | 3 |

| 2024 | 60% | 25% | 15% | 5+ |

Notice how my dependence on primary income decreased over time? That’s financial adaptability in action.

How to Build Adaptability in Your Finances

Start with Skills Inventory List everything you can do that others might pay for. I discovered I could make money from skills I took for granted: writing, Excel expertise, even organizing closets. You have more monetizable skills than you think.

The 10% Rule for Side Hustles Dedicate 10% of your free time to building additional income streams. If you watch TV for 20 hours a week, spend 2 hours building a side hustle instead.

Create Your “Pivot Plan” Before you need it, have a plan for reducing expenses by 30-50%. Know which subscriptions to cancel, which expenses to eliminate, and how quickly you can implement changes.

Pro Tip: Practice living on 80% of your income for three months. This “financial fire drill” shows you exactly what you can cut if needed, and the extra 20% accelerates your wealth building.

VI. Vision & Goal-Setting: Clarity Leads to Success

After five qualities, we arrive at what I consider the MOST IMPORTANT ONE: Vision and goal-setting. Without this, the other qualities are like having a sports car without a destination—impressive, but ultimately pointless.

I used to be a chronic “someday” person. Someday I’d pay off debt. Someday I’d start investing. Someday I’d be financially free. But someday never comes without specific goals and deadlines.

Everything changed when I wrote down exactly what I wanted and by when. That simple act transformed vague wishes into achievable targets.

Setting SMART Financial Goals

Forget fuzzy goals like “save more money” or “get out of debt.” Successful people set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound.

Vague vs. SMART Goal Examples:

| Vague Goal | SMART Goal |

| “Save money” | “Save $10,000 in emergency fund by December 31, 2025” |

| “Pay off debt” | “Pay off $15,000 credit card debt in 18 months using debt snowball method” |

| “Start investing” | “Invest $500 monthly in low-cost index funds starting next month” |

| “Buy a house” | “Save $40,000 for house down payment by age 30” |

See the difference? SMART goals create urgency and clarity.

Creating Your Financial Roadmap

Your financial roadmap should have three time horizons:

Short-term (1 year): Emergency fund, high-interest debt payoff Medium-term (2-5 years): House down payment, car replacement fund Long-term (5+ years): Retirement, children’s education, financial independence

My Current Financial Roadmap:

| Timeline | Goal | Target Amount | Monthly Action |

| 6 months | Emergency fund | $15,000 | Save $1,200/month |

| 2 years | Investment account | $50,000 | Invest $1,500/month |

| 5 years | Rental property down payment | $80,000 | Save $1,000/month |

| 15 years | Financial independence | $1,000,000 | Continue current plan |

Staying Motivated and Tracking Progress

Goals without regular review become forgotten dreams. I review my financial goals every single month, and this habit alone has accelerated my progress by years.

The Monthly Goal Review Process:

- Calculate net worth and compare to last month

- Review progress on each specific goal

- Identify obstacles and problem-solve solutions

- Celebrate wins, no matter how small

- Adjust targets if life circumstances change

Visual Motivation Techniques: I keep a “debt thermometer” on my refrigerator showing credit card balances going down. Seeing daily progress keeps me motivated to skip unnecessary purchases.

How to Build a Clear Financial Vision

The 5-Year Vision Exercise Write a detailed description of your ideal financial life five years from now. Where do you live? What do you do for work? How much money do you have? Be specific. This vision becomes your North Star.

Break It Down Backwards Start with your 5-year vision, then work backward:

- What needs to happen in year 4?

- What about year 3, 2, and 1?

- What must you do this month?

- What can you do today?

Create Accountability Systems Share your goals with someone who will hold you accountable. I text my financial progress to my mentor every month. Knowing someone is watching keeps me honest.

Pro Tip: Take photos of your “why”—family, dream home, travel destinations. Put these images where you’ll see them when tempted to overspend. Emotional connection to goals creates unstoppable momentum.

The bottom line? These six qualities aren’t just financial concepts—they’re life skills that compound over time. Master them, and you don’t just achieve financial freedom; you create a life of choices, security, and unlimited possibility.

Bonus Section: Common Mistakes That Block Financial Freedom

Now that we’ve covered the six essential qualities, let’s talk about the financial landmines that can blow up your best-laid plans. I’ve made every single one of these mistakes, and they cost me years of progress and thousands of dollars.

Think of this section as your financial GPS warning system—helping you avoid the costly detours that keep most people stuck in financial mediocrity.

Mistake #1: Relying Too Heavily on Debt

Here’s a hard truth: Debt is like financial quicksand—the more you struggle with it, the deeper you sink.

I once had $47,000 in various debts: credit cards, car loan, student loans, and even money borrowed from family. I was making decent money but felt like I was running on a financial treadmill—lots of motion, zero progress.

The Hidden Cost of Debt Dependency:

| Debt Type | Average Interest Rate | Monthly Payment on $10,000 | Total Interest Over 5 Years |

| Credit Cards | 18.7% | $254 | $5,240 |

| Personal Loans | 12.5% | $224 | $3,440 |

| Car Loans | 7.8% | $202 | $2,120 |

| Student Loans | 6.2% | $193 | $1,580 |

The debt trap cycle works like this:

- You use credit to maintain lifestyle

- Minimum payments consume more of your income

- Less money available for saving and investing

- Financial stress leads to more emotional spending

- Repeat until you’re drowning

Breaking Free: Use the debt avalanche method—pay minimums on everything, then attack the highest interest rate debt first. I eliminated my debt in 23 months using this strategy.

Mistake #2: Not Tracking Expenses

You can’t manage what you don’t measure. For three years, I wondered where my money went each month. Then I tracked every penny for 30 days and nearly had a heart attack.

I was spending $847 per month on “random stuff”—coffee shops, impulse Amazon purchases, subscription services I forgot I had. That’s over $10,000 per year vanishing into thin air!

Common Expense Blind Spots:

- Subscription services: Average person pays $273/month for subscriptions

- Food delivery: Can cost 3x more than cooking at home

- Banking fees: ATM fees, overdraft charges, monthly account fees

- Insurance overpayment: Not shopping around costs $400+ annually

- Utility waste: Poor energy habits inflate bills by 20-30%

The 30-Day Expense Challenge: Write down every single expense for one month. No judgment, just awareness. You’ll be shocked at what you discover.

Mistake #3: Ignoring Retirement Savings Early On

This mistake haunts me the most because time is the one thing you can never buy back.

I didn’t start seriously saving for retirement until age 29. My excuse? “I’m young, I have plenty of time.” WRONG! Those lost years cost me a fortune.

The Cost of Waiting to Save for Retirement:

| Starting Age | Monthly Savings | Years Saving | Total Contributed | Value at 65* |

| 25 | $300 | 40 years | $144,000 | $786,000 |

| 35 | $300 | 30 years | $108,000 | $367,000 |

| 45 | $300 | 20 years | $72,000 | $165,000 |

*Assuming 7% annual return

Did you catch that? Starting at 25 vs. 35 results in $419,000 MORE at retirement, even though you only contributed $36,000 more. That’s the brutal math of compound interest working against you.

The Fix: Start NOW, even if it’s just $25 per month. Your future self will thank you with tears of joy.

Mistake #4: Keeping Up with the Joneses

Social media has turned “keeping up with the Joneses” into a 24/7 financial torture device. Every scroll through Instagram becomes a comparison trap that destroys financial progress.

I fell into this trap hard. Seeing friends’ vacation photos, new cars, and designer purchases made me feel like I was falling behind. So I started spending money I didn’t have to maintain an image I couldn’t afford.

The Reality Check:

- 78% of Americans live paycheck to paycheck

- Average American has only $400 for emergencies

- Many “wealthy-looking” people are actually drowning in debt

Pro Tip: Unfollow accounts that make you feel financially inadequate. Follow people who inspire smart money habits instead.

Mistake #5: Analysis Paralysis with Investing

Perfect is the enemy of good, especially with investing. I spent two years “researching” the perfect investment strategy while my money earned 0.1% in a savings account.

Meanwhile, a simple S&P 500 index fund returned 12% that year. My perfectionism cost me thousands in missed gains.

Common Analysis Paralysis Symptoms:

- Endlessly comparing investment options

- Waiting for the “perfect” market entry point

- Researching individual stocks for months

- Fear of making the “wrong” choice

The Cure: Start with simple, diversified index funds. You can always optimize later, but you can’t get back time spent on the sidelines.

Conclusion

Congratulations—you now possess the blueprint that separates the financially free from those stuck in the paycheck-to-paycheck cycle.

But here’s what I want you to understand: These six qualities—self-discipline, patience, financial literacy, cash flow management, adaptability, and vision—aren’t magical traits reserved for the wealthy elite. They’re learnable skills that anyone can develop, starting today.

I wasn’t born with these qualities. Five years ago, I was in debt, living paycheck to paycheck, and making every financial mistake in the book. What changed everything wasn’t a lottery win or inheritance—it was the decision to develop these six qualities systematically.

Remember:

- Self-discipline gives you control over your money choices

- Patience lets compound interest work its magic over time

- Financial literacy protects you from costly mistakes

- Cash flow management ensures every dollar has a purpose

- Adaptability keeps you resilient during life’s curveballs

- Vision and goal-setting provide the roadmap to your destination

The beautiful truth is that financial freedom isn’t about having millions in the bank—it’s about having choices. It’s the choice to take a lower-paying job you love. The choice to help family in crisis. The choice to retire when you want, not when you have to.

Your Next Steps:

Pick ONE quality from this article and commit to developing it over the next 30 days. Maybe it’s tracking expenses for self-discipline, or setting your first SMART financial goal for vision. Small, consistent actions create massive results over time.

The path to financial freedom starts with a single step. You have everything you need to begin this journey right now. Your future financially free self is counting on the decisions you make today.

What’s stopping you? Your financial freedom journey begins now.

Ready to Start? Here’s Your Game Plan

Ready to transform your financial life? Here’s how to start building these 6 life-changing qualities TODAY:

Take Action Right Now

Which of these 6 qualities resonates most with you?

Is it self-discipline because you struggle with impulse purchases? Maybe it’s financial literacy because investing feels overwhelming? Or perhaps cash flow management because you never know where your money goes?

I want to hear from you! Drop a comment below and tell me:

- Which quality you’re committing to work on first

- Your biggest financial challenge right now

- One specific action you’ll take in the next 24 hours

Don’t just read and forget—engage with this community of people on the same journey toward financial freedom.

Start Your 30-Day Challenge

Pick ONE quality from this article and commit to a 30-day focused improvement challenge:

Self-Discipline Challenge: Track every expense for 30 days using a simple app or notebook Patience Challenge: Set up automatic investing of $50/month and don’t check the account Financial Literacy Challenge: Read one financial article or watch one educational video daily Cash Flow Challenge: Implement the 50/30/20 rule and stick to it for one month Adaptability Challenge: Start one small side hustle or learn one new monetizable skill Vision Challenge: Write down 5 specific financial goals with deadlines and monthly review them

Join Our Financial Freedom Community

Your journey doesn’t have to be lonely. Connect with others who are building these same qualities:

- Share your progress in the comments section

- Ask questions when you hit roadblocks

- Celebrate victories no matter how small

- Support others who are struggling with challenges you’ve overcome

Remember: Every financially free person started exactly where you are right now. The only difference? They took action instead of just consuming information.

Take The First Step Today

Stop waiting for the “perfect” moment—it doesn’t exist. Whether you’re drowning in debt or just starting your wealth-building journey, you have everything you need to begin.

Your financial freedom is waiting on the other side of action. What will you choose?

Frequently Asked Questions (FAQs)

What are the key qualities needed to achieve financial freedom?

The 6 essential qualities are: self-discipline, patience, financial literacy, cash flow management, adaptability, and vision with goal-setting. These aren’t personality traits you’re born with—they’re learnable skills that anyone can develop over time.

I’ve seen people transform their financial lives by focusing on just one quality at a time. Start with whichever feels most relevant to your current situation.

How can I build habits for financial independence?

Start ridiculously small and be consistent. Don’t try to save $1,000 your first month. Instead, save $50 and do it automatically.

My proven habit-building system:

- Choose one tiny financial action (like tracking daily expenses)

- Do it every day for 30 days

- Gradually increase the complexity or amount

- Celebrate small wins to build momentum

The key is consistency over perfection. I’d rather see you save $25 every month for a year than save $300 once and quit.

What steps should I take to become financially free by age 50?

This depends on your current age and financial situation, but here’s my general roadmap:

In your 20s: Focus on building emergency fund, eliminating high-interest debt, and starting retirement savings In your 30s: Maximize retirement contributions, consider real estate, build multiple income streams In your 40s: Accelerate savings rate, optimize tax strategies, plan specific retirement lifestyle

The magic number: Most financial experts suggest having 25 times your annual expenses saved by retirement. If you need $60,000 per year, aim for $1.5 million in investments.

How important is financial discipline in achieving financial freedom?

Financial discipline is THE foundation—without it, the other qualities don’t matter. You can be the most knowledgeable investor in the world, but if you can’t control your spending, you’ll never build wealth.

I learned this when I had a friend who could analyze stocks like Warren Buffett but couldn’t stop spending his investment money on gadgets. Knowledge without discipline equals broke.

Start with small discipline wins: Use cash for discretionary spending, wait 24 hours before non-essential purchases, automate your savings so you can’t touch it.

What role does budgeting play in reaching financial independence?

Budgeting isn’t about restriction—it’s about intention. A budget tells your money where to go instead of wondering where it went.

My simplified budgeting approach:

- 50% for needs (rent, utilities, groceries)

- 20% for investments and savings (pay yourself FIRST)

- 30% for wants (entertainment, dining out, hobbies)

The key is automating as much as possible. When your savings and investments happen automatically, budgeting becomes much easier.

Can passive income help me achieve financial freedom faster?

Absolutely, but don’t put the cart before the horse. Most “passive” income requires significant upfront work or capital investment.

Real passive income examples:

- Dividend-paying stocks (after you’ve invested thousands)

- Rental properties (after you’ve saved for down payments)

- Creating digital products (after months of development work)

Start by mastering active income and basic investing. Passive income is the advanced level—don’t skip the fundamentals.

How do I set realistic financial goals for independence?

Use the SMART framework: Specific, Measurable, Achievable, Relevant, Time-bound.

Bad goal: “Save more money” SMART goal: “Save $10,000 for emergency fund by December 31, 2025, by automatically transferring $400 per month”

Break big goals into smaller milestones. Instead of focusing on saving $100,000, celebrate your first $1,000, then $5,000, then $10,000. Small wins create momentum for big victories.

What are common mistakes to avoid on the path to financial freedom?

The big three killers:

- Lifestyle inflation: Every raise becomes an excuse to spend more

- Debt dependency: Using credit cards to maintain your lifestyle

- Analysis paralysis: Spending years “researching” instead of taking action

I made all these mistakes. The solution? Start simple, automate good decisions, and focus on consistency over perfection. You can always optimize later, but you can’t get back time spent procrastinating.